New VAT rates in Europe: What is Your Strategy?

The Directive That Changed the Rules

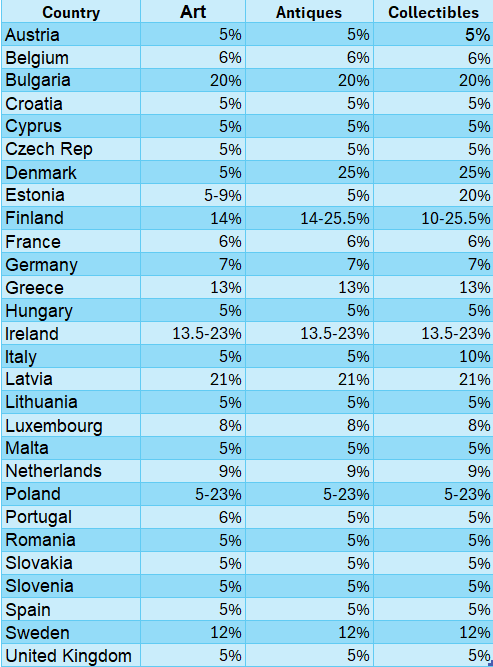

In April 2022, the Council Directive (EU) 2022/542 was adopted, amending long-standing VAT rules across the Union. Its core aim was to give member states greater flexibility in setting VAT rates, particularly for goods and services of cultural significance. For the art world, this meant that works of art, collectors' items, and antiques could benefit from reduced VAT rates as low as 5%, provided member states chose to implement them.

Previously, VAT on art sales and imports often hovered around 20–22%, creating a heavy fiscal burden for galleries, auction houses, and logistics providers. The directive encouraged governments to recalibrate these rates by the end of 2024, sparking a wave of reforms across Europe.

Impact on Art Logistics

The directive's ripple effects have been profound, reshaping how art moves across borders:

- Lower Import Costs: Countries like France (5.5%), Germany (7%), and Italy (5%) slashed VAT on art imports, making it significantly cheaper to bring works into the EU. Logistics firms now handle higher volumes of inbound shipments, as collectors and institutions take advantage of reduced costs.

- Simplified Compliance: By aligning VAT reductions with cultural goods, the directive reduced reliance on complex schemes like the “margin scheme.” This has streamlined customs clearance and documentation, cutting down administrative delays.

- Competitive Hubs: Italy's late but decisive move to adopt the lowest permissible VAT rate (5%) in 2025 positioned it as a prime gateway for art logistics. Auction houses and galleries increasingly route shipments through Italy to benefit from favorable taxation.

- Boost for Secondary Markets: Lower VAT has revitalized the resale of art and antiques. Logistics providers now manage more frequent transfers between private collections, galleries, and fairs, with reduced fiscal friction.

Strategic Shifts in the Art Market

The directive has not only reshaped logistics but also rebalanced Europe's cultural economy:

- Cross-Border Trade Growth: With VAT harmonization, moving art between EU states has become smoother, encouraging pan-European exhibitions and fairs.

- Investor Confidence: Reduced VAT rates signal a more investor-friendly climate, attracting international buyers who previously hesitated due to high import taxes.

- Operational Efficiency: Logistics firms have invested in specialized art transport services, knowing that reduced VAT makes frequent, high-value shipments more viable.

Looking Ahead

The VAT reforms are part of a broader EU push to modernize cultural commerce. Italy, for example, is pairing its VAT reduction with proposals to streamline export licensing and reduce red tape. If other member states follow suit, Europe could see a renaissance in art logistics—where fiscal policy, cultural ambition, and operational efficiency converge.

? Practical Guide: Leveraging the 2022 EU VAT Directive for Art Shipments

1. Understand the VAT Landscape

Know the rates: Member states now have flexibility to apply reduced VAT (as low as 5%) on cultural goods. France, Germany, and Italy have already adopted lower rates for art imports and sales.

Check local implementation: Each country applies the directive differently. For example, Italy reduced VAT on art imports to 5% in 2025, while France applies 5.5%.

? Action: Before shipping, confirm the VAT rate in the destination country. This can significantly affect total landed costs.

2. Optimize Shipping Routes

Choose entry points strategically: Importing through countries with lower VAT (e.g., Italy or France) can reduce costs before redistributing works across the EU.

Consolidate shipments: Logistics providers can group consignments to maximize savings on customs and VAT clearance.

? Action: Work with logistics partners to plan routes that minimize VAT exposure while ensuring compliance.

3. Expand Exhibition Opportunities

Cross-border ease: Lower VAT makes temporary imports for fairs and exhibitions more affordable.

Institutional collaboration: Museums and galleries can now borrow and lend works across borders with reduced fiscal friction.

? Action: Factor VAT savings into exhibition budgets to expand programming and international partnerships.

4. Strengthen Collector Confidence

Lower acquisition costs: Reduced VAT encourages international buyers to purchase within the EU.

Resale market growth: Collectors benefit from lower costs when reselling, boosting liquidity in the art market.

? Action: Communicate VAT advantages clearly to clients — it's a selling point for both galleries and auction houses.

5. Compliance & Risk Management

Stay updated: VAT rules are evolving, and member states may adjust rates further.

Audit regularly: Ensure invoices, consignment notes, and customs declarations reflect the correct VAT rate.

? Action: Partner with logistics specialists to maintain compliance while maximizing savings.

Prime Lane: Your Trusted Partner in Art Logistics

Navigating the international shipping of art, antiques, and collectables requires more than just careful handling — it demands precision in paperwork, deep regulatory knowledge, and strategic foresight. That's where Prime Lane excels. As specialists in safe packing and global transportation, Prime Lane supports galleries, artists, antique dealers, and collectors in avoiding costly mistakes. The difference between documentation prepared by seasoned experts and that done by amateurs can mean hundreds or even thousands of pounds lost due to misapplied VAT rates or incorrect customs declarations. With the 2022 EU directive introducing preferential VAT rates for cultural goods, Prime Lane ensures your shipments are compliant, cost-efficient, and protected every step of the way. Whether you're planning a cross-border exhibition or acquiring a rare piece, you can count on Prime Lane's expertise. Contact us via email, phone, or WhatsApp — we're here to help.